.

Ethiopia tries to crack down on livestock black market

By Matthew Newsome, in Addis Ababa, 11-Feb-2014

Ethiopia’s large livestock industry is set to undergo a shake-up following a new livestock trading bill, passed on 21 January. The new law, due to be enforced in March, is designed to tighten Ethiopia’s livestock market, increasing its efficiency and value by eliminating middle-men, unregulated animal markets and illegal cross-border trades.

http://www.globalmeatnews.com/Industry-Markets/Ethiopia-tries-to-crack-down-on-livestock-black-market

.

MH Engineering Won Design Competition for EIC’s HQ Building

.

MH Engineering PLC won the architectural design competition of Ethiopian Insurance Corporation’s multi-purpose building, Capital reported.

The second and third runner ups, Image Consultancy PLC and Virtual Consulting PLC were awarded trophies.

Located around Ambassador park area on 12,000sqm, the construction of the corporations 33-storey building is estimated to cost 2.2 billion birr, according to Capital. The building will be used as the corporation’s headquarters, and the remaining space will rented out to other commercial services.

Since the corporation secured the plot for the construction of its headquarter in 2012, 21 consulting and engineering companies competed. Five designs were chosen as finalists and their designs were displayed at the Sheraton on February 4, the day of the award.

The Ethiopian Insurance Corporation was established in 1968. The corporation provides more than 15 types of life insurance as well as more than 30 non-life Insurance policies.

MH Engineering PLC was established in 1997. Since its formation, the company has designed and supervised the construction of over 300 buildings, according to Capital.

http://www.2merkato.com/news/alerts/2836-ethiopia-mh-engineering-won-design-competition-for-eic-s-hq-building

.

Moody’s in Town

.

While the Ministry of Finance and Economic Development (MoFED) stayed in contact with Lazard Limited Bank and asset management, a French company that is recruited to initiate proceedings for credit rating and select an agency, officials of one of the three well-known rating agencies in world, Moody’s, are reported to be in town this week.

Following government’s intention to tap into the sovereign debt market which requires the country to go through proper credit rating, Sufian Ahmed, minister of Finance and Economic Development, disclosed that plans to recruit a rating agencies is already underway. The process, will enable the country to be part of the lists of countries whose financial standing and credit worthiness is known. Tapping into the sovereign debt market is sought to provide a relief to the severe foreign exchange shortage which major mega projects of Ethiopia are facing at this time.

Fitch, Standard & Poor’s (S&P), Moody’s or Trading and Economics are agencies renowned for the credit rating, and these are also the very firms that countries around world employ to do the job. Although the reason for the visit is not yet disclosed, Moody’s is one of the major contending agency to clinch job of rating the Ethiopian economy.

Sources close to the matter confirmed to The Reporter that Moody’s arrival in town is an indication that the job might already been given to them. However, efforts made by The Reporter to obtain comments from MoFED was unfruitful.

According to literature, sovereign credit rating is a rating of a sovereign nation to assess the level of risk associated with lending to a given country. The credit rating also takes into account the political risk in that specific country and is usually used by companies while considering to invest abroad.

The credit rating has become at the center of the government’s attention following the comings of giant international companies which require some degree of confidence in the country. French companies for instance even went to the extent of asking Sufian whether Ethiopia is considering credit rating sooner so that if and when they decide to come to invest in Ethiopia they can access foreign credit.

http://www.thereporterethiopia.com/index.php/news-headlines/item/1604-moody’s-in-town

.

Court Upgrades CCMS Data Base System

.

The Federal Supreme Court (FSC) has upgraded its 2.4 version of Court Case Management System (CCMS) to the latest 2.5 version with a view to rendering timely and efficient services to its clients.

The court has adopted various new technologies in a bid to facilitate its day-to-day activities and satisfy the interests of the court clients, says Medhen Kiros, Federal Supreme Court Vice President.

“The newly upgraded CCMS Data Base System enables anyone who wants to know the status of his/her case online using the court website as long as there is an Internet connection,” he said. “It includes more than thirty pieces of information than the former System and helps to investigate and prevent criminal acts as well.”

The system would play an enormous role in protecting the rights of children against violence, entering full data with regard to lawsuits of adoption, inheritance and civil code, among others.

Currently 23 courts are using video conference to preside over various cases throughout the country.

http://allafrica.com/stories/201402111046.html

.

Meles Memorial Library, ICT Centre inaugurated

.![]()

Addis Ababa - Meles Zenawi Hub Library and ICT Centre was launched and handed over the Ethiopian Civil Service University (ECSU) as one of ‘Thank You Small Library’ Programme at the university main campus here on yesterday.

The programme was sponsored by UN WTO Sustainable Tourism for Eliminating Poverty (ST-EP) Foundation and the Korean Ministry of Culture and Tourism.

Civil Service Sate Minister Adamu Ayana said that the donation of books, multimedia and other educational equipment significantly contribute to build the capacity of institutions and human resource in various sectors.

ESCU President Dr. Haile-Michael Abera noted that the donation is part of the assistance of ROK government to Ethiopia to build the capacity of civil servants and support the educational training and research activity in memory of the late Prime Minister Meles Zenawi.

Ambassador Dho Young-Shim, Chairperson of the UNWTO- Sustainable Tourism for Eliminating Poverty Foundation and UN MDGs Advocate also said: “I was born when Korea was very poor. Now, it has advanced economy in the world not because of natural resources but because of books .Thus, Ethiopia has also to focus on books.”

South Korean Ambassador to Ethiopia Kim Jong Geun said that since the establishment of the first pilot project in Accra, Ghana in 2007, the Thank You Small Library initiative focuses on establishing small libraries in underprivileged communities where students do not have access to reading facilities.

“ESCU students —brimming with talent, energy and hope— would make a great contribution to Ethiopia’s development by drawing upon the wisdom they acquire from books delivered today,” the ambassador said.

ESCU President and Ambassador Dho Young-Shim on the occasion signed an agreement to set up and manage the UN MDGs. The Ambassador has also handed over 6,000 books to the ESCU President.

According o the Ethiopian Herald, the library and the centre valued at about five million birr.

.

Delay in transformer provision strangling water projects

.

![]()

Yergalem transformer burnt after three days of service

Photo: Ministry of Water,Irrigation and Energy

Oromia State–The supply of clean water and sanitation services to the public is among the overriding concern of the government. The preoccupation is well founded. Despite the nationwide increased clean water coverage –67 per cent – the public’s cry for sustainable clean water and sanitation services, more than ever, is getting loud.

As part of its regular schedule, the Natural Resources and Environmental Protection Affairs Standing Committee of the House of Peoples’ Representatives (HPR) last month inspected eight water expansion projects in Oromia and Southern Nations, Nationalities and Peoples’ (SNNP) states. Beginning at Bule-Hora committee members concluded their visits at Sebeta town Oromia State.

The visit was aimed at assessing the progress of various government-run projects. It as well eyed at identifying challenges and replicate best practices.

In general, the Committee was very happy with the projects’ performance. It gave directions and set time frame for the remaining works. It also reprimanded some for lack of commitment and accountability.

“The remaining tasks have to be completed according to schedule. The public’s cry for water has to be heard. We all have responsibility and accountability to the public.”

The Committee also urged all stakeholders to enthusiastically see to the completion of the remaining works. “They have to ensure the completion of the much awaited water projects giving due attention to the significance of public mobilization and participation to create a sense of community ownership.”

Despite the many millions of hard earned dollars invested by the government as well as development partners alike and the completion of the projects’ construction works, except Yergalem (partially) and Alaba, not a single drop of water has reached taps to the despair of the communities. The major problem impeding the projects from going operational is delay in the provision of transformers. Failure of those at hand to effectively serve makes the problem even worse. The problem is also attributed to tardiness in the supply of pipes and fitting ( electro-mechanical), lack of cooperation and coordination as well as negligence in monitoring and accountability.

Berket Melkamu is Bule-Hora Water Expansion Project Resident Consultant. According to him, the three new boreholes are capable of pumping 68 liters per second and also have enough clean water to serve the town with a population of over 91,000. “Initially, the plan was to finalize the construction in one year but was delayed by eight months. Delay in the acquisition of transformers, pipe supply and fitting as well as resolving boundary demarcation are some of the factors affecting the execution of the project.”

Getahun Tagessee, G.T.B Engineering Manager also said the 91 million birr project is 98 per cent complete and designed to serve for 20 years. “Though we settled the payment for the purchase of a transformer six months back, we have not received nor heard appropriate response from EPPCo. But, we have already begun the installation of power lines.”

The same story is true with Yergalem, Meki, Modjo, Bishoftu, Burayu and Sebeta projects. Almost all civil construction works are through. In some cases, the electro-mechanical as well as pipe fittings are completed while some are in the process but no transformers are in sight. More shockingly, of the two delivered for Yergalem, one was burnt-out only after three days of service.

Ethiopian Power Authority (EPA) SNNPS Branch Marketing Head Tadele Merga said the transformer delay was caused due to increased demand. Currently, Metal and Engineering Corporation, is manufacturing transformers. “Hopefully, the problem will be addressed soon. But, I have no information about the burnt-out transformer.”

EPA External Relations Head Miskir Negash also said supplying power to water projects is Agency’s priority. The delay is attributed to the growing demand for transformers. “ It is a matter of time. METC is manufacturing and supplying world standard transformers.”

But he could not fix an exact time. “We will try to prioritize but we cannot give a definite time frame. People have to wait patiently.”

The other complaint voiced by contractors, engineers and water bureaus is lack of cooperation and coordination between sectoral bureaus.

The main water pump was laid at Modjo in the area now demarcated for the new Addis-Djibouti railway crossing point. Now the pumps are dug. They are lying on the ground, waiting for a decision to lay them over or under the railway lines.

Town Water Utility Enterprise Head Yehualshet Demi said the total cost of the water expansion project is over 95 million birr. Almost all the civil and electro-mechanical works are completed. But discussion on right-of-way is still going on between the Water Bureau and the Ethiopian Railway Authority.

“Formal and informal communications have taken over a year. Now, we have reached at a verbal agreement to seal and lay the pumps under the lines. But we are not sure when the decision will be translated into action,” he added. Though we had paid for five transformers years back still none is supplied.

“ The right time for a solution is now. We urge the Committee to help us solve the right-of -way deadlock. We have tried our level best but things have proved beyond the Bureau’s capacity.”

Deputy Mayor Gido Lemma said currently, the town’s water shortage is very severe. “If one goes there right now, one will see many carrying yellow jerry cans in search of water. Some have even reverted back to drinking the contaminated river water.”

“The public demand for clean water is legitimate and the delay is associated with lack of good governance. The public is loosing confidence in us.”

The other serious obstacle is lack of commitment and accountability which is conspiring against the public legitimate right to clean water.

Like other projects, Sebeta also suffers from delay owing to problems related to transformer and pipe fitting works and delivery. The project was expected to be completed in one month but it might take another three months or more, said Ziad Geletu the Resident Consultant.

United Contractors is one of the five contractors responsible for lot 4 pipe fitting works which is lagging behind but also key to the overall project completion. “ So far, only 58 per cent has been accomplished on the site and 14 per cent of pipe fitting is not yet delivered.”

Asked whether the contractor could deliver and complete the fitting within 20 days set by the Ministry and the Committee, he said: “ We have ordered so, but we are not sure when it will be delivered. It might take up to three months.”

The response from the committee and the State Minister was strong. The government is determined to provide clean water for citizens. But negligence and incompetence are becoming hindrances.

“ It was the consultants’ job to monitor contractors to complete projects on time. They should be on the client and the public side not on that of the contractors.”

Water, Irrigation and Energy State Minister Kebede Gerba also reprimanded the contractor and the consultants. “ The Ministry can and should take action. Unless you rise up to your objectives your licences will be revoked.”

http://www.ethpress.gov.et/herald/index.php/herald/news/5908-delay-in-transformer-provision-strangling-water-projects

.

Services Shortages Stunt Housing Developments

.

![]()

The condominium houses under construction in the Yeka Abado site.

.

The deadline for a number of condominiums has been pushed back due to shortages in electricity and water

.

Water and electricity shortages are hampering the proper and timely construction of condominium houses at the Bole Arabsa site – the biggest of the numerous housing projects in Addis Abeba.

The 20,023 houses are located close to Bole International Airport. They are part of the 50,000 planned to be constructed by the Addis Abeba City Administration during the 2013/14 fiscal year.

Water scarcity has been forcing the project managers to fetch water from as far away as 10 km.

“Big vehicles have been transporting water to the project site,” HaileliulGetye, Kirkos project manager under the Addis Abeba Housing Agency,informed a crew of journalists, who moved to the site with officials from the Ministry of Urban Development & Construction (MoUDC) on Friday, February 7, 2014, to visit the construction of 40/60 and 10/90 condominium houses. “There are times when up to 50 big water tankers are transported within a single day.”

The Agency plans to transfer 26,000 houses under the 20/80 and 14,000 houses, for the first time, under the 10/90 scheme, in 2013/14. Close to 3,000 of these units will be stores for rent.

Divided into three sub-projects, the Bole Arabsa project includes Lideta, Kirkos and Project 15. It has 674 buildings up to seven storeys high. The project covers an area of over 230 hectares.

Although the plan was to finish construction by the end of the 2013/14 fiscal year and distribute the homes to beneficiaries, shortages in transport, water, electricity and other basic facilities has forced the Agency to extend the deadline to the middle of the 2014/15 fiscal year.

Road and transportation issues are also hindering the speed of the construction. Approximately 252 project staff members, 288 contractors, five consultants with full staff and 430 micro & small enterprises (MSEs) with an 8,000 strong labour force, find it difficult to come to the project site, as they live far away, much closer to downtown Addis Abeba, according to Haileleul.

“We have nine city buses providing a transport service, but it still falls far short of meeting the demand,” he lamented.

Working under all this pressure, the project has constructed 65pc of the 10/90 houses, which are all two storey buildings. The construction of the 20/80 houses has reached 55pc completion.

The government planned to construct 95,000 houses in Addis Abeba in the year 2012/13 at a cost of 16 billion Br.

Another site visited by the crew is the YekaAbado project, located close to Sendafa, 40 km from Addis Abeba. Covering an area of 250 hectares, the project started in 2011 and has 570 buildings, ranging from two to seven-storey buildings. The project manager, WerkuAbera, says there are 367 contractors at the site and 570 MSEs, with more than 8,000 members. Some projects are 65 to 89pc completed.

In the 40/60 housing scheme alone, 50,000 houses will be built at a cost of 26.05 billion Br. A total of 10,000 of them will be completed during the 2014/15 fiscal year. The financing will be secured from “different finance sources,” according to the executive summary of activities released by the Addis Abeba City Administration, in July 2013.

http://addisfortune.net/articles/services-shortages-stunt-housing-developments/

.

Heineken receives Fermentation tanks

.

![]()

After a wait of six weeks, Heineken Greenfield Brewery finally received six new fermentation tanks on February 7.

The tanks came to the country via the Djibouti route.

.

Heineken entered the Ethiopian market when it purchased Bedele Brewery S.C. and Harar Brewery S.C. for USD 163.4 million in 2011. It expended an additional 45 million Euros to upgrade the two breweries.

It has since started construction of its new Greenfield brewery Kilinto which will start production later this year according to the company’s public relations office. The cost of the factory is over 127 million Euros.

Heineken is not the only international brewery interested in Ethiopia. United kingdom based Diageo leveled the playing field a bit by purchasing Meta Abo Brewery for USD 225 million. The other global giant interested in the game is Bavaria N.V. Brewery which owns 49.9 percent of Habesha Breweries S.C.

The production capacity of the new brewery which stands on a 25ha plot is estimated at 1.5 million hectoliters. Ethiopia’s average annual beer consumption stands at five liters per person annually, while Kenya’s is 12 liters. The Czech Republic tops the list with 131.7 liters a person.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4027:heineken-receives-fermentation-tanks&catid=35:capital&Itemid=27

.

Ministry finalizes construction industry draft proclamation

.

The Ministry of Urban Development, Housing and Construction presented its final draft proclamation, the first of its kind in the sector, for discussion with stakeholders. The proclamation would help to create accountable and transparent ways of operation in the construction industry.

Briefing forum participants yesterday, State Minister Haile-Meskel Tefera said the new draft proclamation will enable ensure competency and foster quality in the construction industry. It adds to the strategy of collecting all the necessary data related to the construction sector which was missing in the previous working system, he noted. “It could enable us register and evaluate performance contractors, experts and consultants in the sector,” he added.

Haile-Meskel said the new proclamation is mainly vital for the flourishing of professionalism in the industry. The services in the sector need to be rendered with ultimate quality based on ethical standards, he said. As the proclamation helps to fill gaps in quality, timeliness and other present challenges, it would create better benefits for the users, he noted.

In contrast to the previous way, those who want to engage in the construction sector must first have letter of competence before trade license, when this proclamation is ratified and becomes a governing law in the sector. A new registration body is expected to be established to enforce the proclamation. The proclamation allows those engaged in the sector to submit complaints related to registration and other issues to a committee that would be formed.

It also stipulates that any one found operation in the sector without letter of competence would be fined from 150,000 up to 300,000 birr and from seven to 15 years of imprisonment. Those who intentionally make contracts with any one who does not have letter of competence will also face punishment, according to the proclamation.

http://www.ethpress.gov.et/herald/index.php/herald/national-news/5913-ministry-finalizes-construction-industry-draft-proclamation

.

Africa’s Green Revolution is Ready to Go: Just Add Investments

.

African agriculture is about to flourish. Africa is one of the most fertile regions on Earth, with 60 percent of the world’s uncultivated arable land.

While one in four Africans still go hungry, and the continent still imports 40 percent of its food needs, we believe recent developments all across Africa shows tremendous promise; so much so that we are now investing significant amounts of our own money in African agriculture ventures.

Africa’s huge potential is an opportunity far beyond the continent itself. It could be a driver of global growth and food security. Over the past decade, the continent has harbored some of the fastest growing economies in the world, to a large extent linked to oil, gas, and mining.

Growth like that draws investors looking for further opportunities – and African agriculture has abundant opportunities: in equipment, transport, irrigation and infrastructure; investment for farmers to go from subsistence to commercial farming; and investment in training, research and support for smallholders as well as small and medium enterprises. Such investments could deliver manifold returns; for the investors, yes, but also in terms of jobs, food security and better incomes for small farmers.

Yet, Africa still lacks viable ways of channeling investment money to the millions of dynamic entrepreneurs with viable business ideas in sectors such as farming, aquaculture and agro-processing. Indeed, Africa is losing potential investments each year worth huge amounts of money. This loss has knock-on effects for jobs and economic growth.

The challenge is to remove the obstacles that prevent this investment money from reaching African opportunities.

Chaired by former UN Secretary-General Kofi Annan, the Africa Progress Panel will this year explore ways of meeting this challenge. Its report will focus on how African farmers and fishing communities can access the money they need to create green and blue revolutions in Africa.

One crucial priority is to reduce the cost of money. Real interest rates on loans to agricultural projects (and to small shops and industry ventures, for that matter) exceed 20 percent in many African countries. No business can thrive if it has to borrow at such rates. It should be possible to get these rates well below 10 percent – even in so-called frontier markets – if we simplify banking, reduce perceptions of risk, and introduce functioning insurance.

Venture capital and equity must also be made more available. Financing from international and regional financial institutions could be put to good use by guaranteeing and underwriting equity investors who invest in small enterprises. And we need to make Africa’s stock markets accessible to small and international actors.

Farmers also need well-regulated commodity exchanges so they can sell their products at global market rates, rather than to monopoly buyers who squeeze the prices.

Should governments just “get out of the way” and let the private sector sort these questions out by itself? Absolutely not. If the past five years of global crisis have taught us anything, it is that markets work best when they are well regulated for the benefit of society.

Governments need to ensure, for example, that smallholder farmers – especially women – can access new sources of credit and equity, and that they are not squeezed out by large agribusiness. Governments can encourage the creation of co-operatives, provide technical support and training, help with the development of new seed varieties, invest in roads and water systems, and protect against predatory investors.

Africa needs large, commercial farms as well as small ones. But it doesn’t need foreign investors who appropriate Africa’s land and water to supply food and biofuels to other countries, while creating few jobs and driving populations off the land. Only strong and principled policies by responsible governments can ensure the right balance between large and small, foreign and local.

Such a balance is already being struck in some countries. Nigeria’s agriculture minister has launched an ambitious plan to add 20 million metric tons of food to the domestic supply, while creating 3.5 million new jobs. This is a continuation of previous program which has made Nigeria reach over 75 percent of its job creation target and has met the first Millennium Development Goal, cutting hunger by half, three years ahead of schedule.

Other countries are making similar strides. Such success stories exist all over Africa. If we scale these up, the continent can rid itself of hunger within a decade, create jobs and generate inclusive growth in Africa and far beyond

http://www.ethiopiainvestor.com/index.php?option=com_content&task=view&id=4801&Itemid=88

.

South creates 590 mln. birr market chains

.

Trade, Industry and Urban Development Bureau of Southern Nations, Nationalities and Peoples’ State said market chains estimated at over 590 million birr were created for micro and small enterprises during the first six months of the current budget year.

The Bureau told ENA that the market chains were created for micro and small enterprises engaged in manufacturing and service sectors.

These micro and small enterprises created jobs for more than 116,000 people.

Meanwhile, 116,350 youth are engaged in micro and small enterprises in the State during the first half of the current budget year, the Bureau said. More than 35 per cent of the stated people are women.

The youth are engaged in manufacturing, construction, food processing, trade, agriculture, and service sectors, among others.

More than 100 million birr loan was distributed among the stated number of youth.

http://www.ethpress.gov.et/herald/index.php/herald/national-news/5914-south-creates-590-mln-birr-market-chains

.

Arkebe now board chair of Railway Corporation

.

![]()

The veteran Tigrai Peoples’ Liberation Front (TPLF) fighter, Arkebe Ouqubai has been assigned as Board Chair of the Ethiopian Railway Corporation (ERC) replacing the mayor of the Addis Ababa City Administration Diriba Kuma.

Arkebe was assigned in a letter written by PM Hailemariam Desalegn as the board chairman of the railway corporation three weeks back.

Arkebe was working as an advisor of the Prime Minister with a ministerial portfolio on construction related issues.

Arkebe Ouqubai also got his PhD from the School of Oriental and African Studies in London. The former ERC board chairman, Diriba Kuma, mayor of the Addis Ababa City Administration, has led the corporation, which undertakes the multibillion dollar projects throughout the country for over one year.

The current PM Hailemariam had also led the corporation for many years.

Sources said that Arkebe is responsible for the corporation because there are a lot of decisions to make and it needs a lot of guidance right now and the mayor’s responsibilities at the city did not allow him to follow the corporation’s activities in a proper manner. “This is the main reason for the replacement,” a source who is close to the matter told Capital.

Before the 2005 election Arkebe led Addis Ababa and also served as State Minister of Urban Development. His achievement and leadership capacity in the Addis Ababa city Administration has made Arkebe popular in the country. His close friends describe Arekbe as a workaholic and are confident that he will make remarkable achievements in constructing the railway system that stretches all over the country.

Diriba is currently board chairman of the state monopoly Ethio-Telecom.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4033:arkebe-now-board-chair-of-railway-corporation-&catid=35:capital&Itemid=27

.

Still a long way to go for the road sector

.

![]()

.

It was prior to the second Italian occupation i.e. between the years 1896 and 1936 that a great success was made in road construction. Emperor Menilik is said to be a successful leader in terms of expanding road networks in Ethiopia with the emperor himself participating in road construction. In 1903 the road from Eritrea to Addis Ababa and the road from Addis to Addis Alem were built. In addition it was during this time that the first asphalt roads appeared in Addis. Various road sector development programmes have been implemented during the successive regimes then after. However, a leap forward was made in the last couple of decades. According to data obtained from the Ethiopian Roads Authority (ERA), the total road network in Ethiopia has increased on average by about 4.2% each year since the inception of the Road Sector Development Programme (RSDP), which is now on its fourth stage.

Via this programme ERA has been able to newly interconnect various areas which did not have adequate road networks for effective developmental linkages. The authority’s efforts during the first half of this budget year to make the GTP goal set for the sector a reality were lately evaluated by the Transport and Communication Standing Committee of the House of Peoples’ Representatives. The committee scrutinized various challenges and pitfalls that should be abated to improve the authority’s performance in the remaining months.

ERA should work with better coordination and cooperation with stakeholders like EEPCO, Ethio telecom, and Water and Sewerage Authority to prevent various problems that are arising in the installation of electric, water and telephone infrastructures, Committee Chairperson Kefelech Denboba noted. The bidding and procurement systems employed by the authority should be made transparent in a way that it doesn’t allow corrupt and illicit ways, she stressed. It should take tangible and corrective measures against badly performing domestic and foreign contractors and create a forum whereby contractors share experiences from one another, the committee underlined.

The report by the Authority to the standing committee indicates that 63 of the 224 projects underway are lagging behind schedule and the committee urged their accomplishment to be considerably improved in the remaining months. From the perspective of attaining the GTP, the authority’s performance so far in strengthening major roads, improving the state of feeder roads, construction of feeder roads and high-level maintenance sub-programs was found below the needed level, the committee’s feedback showed. The report was said to have failed to incorporate efforts made to abate rent seeking tendencies and the gained outcomes as recommended by it during the previous years.

The Federal Auditor General did recommend the authority to take corrective measures in its bidding and procurement processes and the committee called for the implementation of the recommendations given by the Auditor General. Moreover the Standing Committee also suggested the Authority took seriously the participation of women and people with disabilities. The Committee identified the issue of corruption and rent seeking behaviours, highly delayed projects that are becoming causes of societal woes, absence of transparency in bidding and procurement processes, poor performance in Universal Rural Road Access Programme (URRAP) to be given due emphasis in the remaining months of the budget year.

Authority Head Zayid Woldegebriel while responding to questions raised by members of the committee said the authority is operating under very severe financial, consultancy, contractor-related and other related challenges. According to him, only eight of the 30 projects that were scheduled to be newly commenced during the budget year have so far started and six more are on the pipeline. However, he is optimistic that all of them may be started in the remaining months. With respect to procurement and bidding he argued that as the authority runs huge sum of money as compared to other institutions, it should be allowed to adapt its own suitable systems, and also indicated that the issue is under negotiation with the Ministry of Finance and Economic Development. Delay of imported inputs due to customs related processes, delayed return of VAT, lack of adequate credit provision from the banks, and severe shortage of foreign exchange are among the challenges that the authority is operating under, he noted. Zaid also indicated that theft and embezzlement of expensive and heavy machines and equipment is posing considerable challenges in many project sites of the authority.

Ethiopia has an agriculture-based society with the majority of the population living in rural areas. Expenditures on major trunk roads often dwarf that of rural roads or low access options. The poorest of the poor are found in rural areas. Hence, road infrastructure investments should address problems of the majority of the population living in rural areas. The poor are concentrated in the rural areas and development efforts should, therefore, be focused there. Roads connect the rural poor to economic and social services that are essential to the improvements of their standard of living. Rural per capita income is lowest in the country’s remote areas where roads are lacking. Cognizant of this, the government planned to construct 71 thousand kilometers of road in various rural areas under URRAP programme of the GTP.

However, this programme seems far lagging behind the plan that only 30 thousand kilometers of the road are so far constructed, which is about 45 per cent of the total road length planned to be constructed till the end of next year. The performance of the URRAP, which is mainly run by the regional states and monitored and supervised by ERA, has shown 38 per cent decrease during the last six months as compared to the same period last year. Some members of the committee also reflected that it has become a safe haven for rent seekers and embezzlers. The committee as a result requested ERA to closely supervise, monitor and support the URRAP.

“There is a great difference among the regions in performing the programme. But we should not deny that the URRAP has created considerable job opportunities in all the regions,” Ziad said. Due emphasis should be given to proper utilization of the newly built roads via this programme and ERA would strengthen its inspection and support, he added.

In sum, although ERA has made considerable progress in expanding and building new roads that are interconnecting new areas which did not have one for decades, it is still trailing due to age-old challenges. Many of its projects are still lagging behind schedule. The sector is facing corruption, embezzlement and theft as its major obstacles, and that need to be urgently addressed.

http://www.ethpress.gov.et/herald/index.php/herald/development/5919-still-a-long-way-to-go-for-the-road-sector

.

Draft regulation by AACRA brings new fines

.

![]()

The Addis Ababa City Roads Authority has drafted a new regulation to be enforced to make roads safer and more efficient.

More people are vandalizing public property and being irresponsible in ways that pose a danger to public safety, according to the document.

According to the drafted document, things are happening on sidewalks that are huge safety hazards and constrict traffic flow. Dumping construction materials, washing cars, illegal parking, setting up tents or pavilions for exhibitions, throwing out garbage and vending illegally all make the public’s environment unsafe.

Roads are also being inappropriately used in ways that damage roads and block traffic. Construction sites often close off roads because employees dump construction materials like cement, steel, and soil that is dug up for the project.

Drainage systems through out the city are also under a lot of pressure as it is misused by different establishment owners as well as residences. The document states that often time people dig up the drainage systems so that it will connect with their residence’s sewage system while hotels as well as factories also engage in similar activities to get rid of their liquid waste.

The drafted regulation lists several offences that will be punishable by fines. Among these are dumping solid waste on the streets by residents will be fined 100 birr, similarly, if it is from an industry the fine will be 7,000 birr and from health facilities 5,000 birr.

Dumping construction materials on sidewalks or roads will be punishable by 1,000 birr while selling or moving livestock on roads will be followed by a hefty fine of 8,000 birr.

The document states that individuals who knowingly or unknowingly cause damage to public properties such as street lights, traffic signs or traffic lights will be fined 500 birr. Urinating and defecation will also be punishable by 50 birr.

Posting advertisements without permission from appropriate bodies on electric poles, bridges and other areas is to be punishable by 500 birr.

The regulations will be enforced by the Law Enforcement Office, by the police as well as the road administration.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4032:draft-regulation-by-aacra-brings-new-fines-&catid=35:capital&Itemid=27

.

Bidding Process Questioned in National Switch System

.

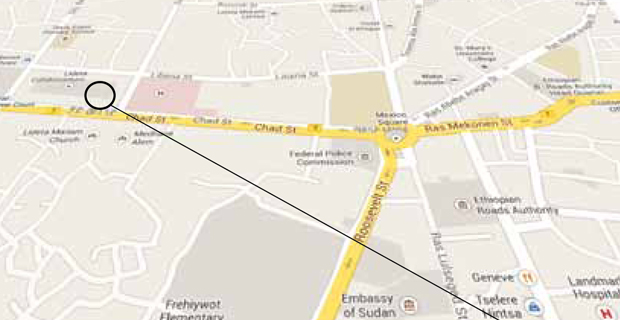

![]()

The headquarters of Awash International Bank (AIB), left, and Commercial bank of Ethiopia (CBE), right,

located around the National Theater along the Ras Abebe Aregay Street.

.

There are concerns that hidden costs will inflate the bid of the number one listed company beyond its closest rival

Eth-Switch SC – a consortium of all banks, established to provide a national switch system – is close to awarding a contract for the supply and implementation of a National Electronic Funds Transfer (EFT) Switch Clearing Settlement and Reconciliation System to Compass Plus Limited – a British IT vendor.

Some members of Eth-Switch’s bid committee – which consists of officials from the National Bank of Ethiopia (NBE), Nib International Bank (NIB) and the Oromia International Bank (OIB), among others – are expressing concerns, however, with the bidding process, questioning its integrity.

The critics reason that the price offered by the number one listed company, Compass Plus, has hidden costs that will push the price of the project beyond that of the second bidder, BPC Banking Technologies.

An official of the state-owned bank, who disagreed with the tender process, saying that it violates the Federal Public Procurement Directive issued in 2010, withdrew from the evaluation process, citing disagreement, a source close to the case told Fortune.

A group of bank lawyers approached Eth-Switch to rectify irregularities in the tender, Fortune leant. One of these lawyers is a member of the technical evaluation committee.

The hidden costs include – additional payment for ATM machines; additional cards, such as Point of Sale (PoS) and ATM (Visa) cards, and license renewal payments.

Some members went to Sudan to see the switch solution that Compass Plus installed. Upon arrival, however, the members were only shown the switch system that S2M – a Moroccan company – had installed. This was because the system of Compass Plus crashed on four different occasions, sources disclosed.

Compass Plus develops and implements a range of electronic payment technologies, which power all-scale retail banking and electronic payment systems. The Company provides a payment solution called Tranzware. This solution provides several billion transactions a year; driving 20,000 ATMs and 170,000 PoS terminals, whilst supporting over 90 million cards.

BPC offered 17 million dollars, while Compass Plus offered 11 million dollars, for the switch system that is expected to enable all banks in Ethiopia to electronically transfer funds and clear cheques between themselves. This is in addition to sharing each other’s Automated Teller Machines (ATMs).

But the amount of money offered by both of the companies is beyond the financial capacity of Eth-Switch, whose capital is only 80 million Br.

Eth-Switch, therefore, revised the ToR (Terms of Reference) in order to cancel the turnkey aspects of the project. These included the switch system, data centre, transfer of knowledge, hands of holding and training. The revised ToR only requires the switch system, thus reducing the cost of the project by 80pc.

But this caused another disagreement among members of the tender committee. Some said that if the ToR is going to be revised, into a component level from that of a turnkey level, then the committee must retender, or possibly float a restricted tender to save time.

A restricted tender is conducted if there is a change in the ToR. It is price-based and includes at least five bidders, including the shortlisted ones and others from the previous tender.

Eth-Switch, nevertheless, continued to deal only with Compass Plus. In a letter dated November 27, 2013, it declined BPS’s request, on November 8, 2013, that it be given the opportunity to resubmit an updated financial bid. Eth-Switch also informed BPS that doing so would lead to a violation of the governing terms and conditions of the bid document.

Eth-Switch floated the tender back on February 21, 2012 and 14 IT vendors participated. The bidding committee conducted a technical evaluation and disclosed the first stage result of four shortlisted companies – S2M, M2M, BPC and Compass Plus.

Months later, Eth-Switch disclosed the second stage, where the bid was narrowed down to BPC and Compass Plus.

The financial proposals of the two companies were opened on May 7, 2013.

Compass Plus is close to being awarded the contract, according to sources. Eth-Switch has informed them, however, that the tender process is under review.

http://addisfortune.net/articles/bidding-process-questioned-in-national-switch-system/

.

Investment Agency revokes licenses of over 1,000 companies

.

The Ethiopian Investment Agency canceled investment licenses of over a thousand companies. The decision came after a warning was posted for a list of 2,497 companies to report to the Agency to avoid having their investment licenses revoked.

“We gave the warning in the beginning of January and now we have revoked investment licenses of companies who were not able to report as the warning stated,” said Aschalew Tadesse from the Public Relations office at the Investment Agency.

Some of those that have had their licenses revoked are; CRBC Addis Engineering Plc’s license for an expansion, East African Pharmaceuticals expansion project, Holland Car Plc and Access Resorts Hotel Plc.

The list of the companies which was posted at the Agency’s office was divided into three main sectors which were tour operation, machinery rentals and agriculture.

The list also includes companies such as Deventus Wind Technology Plc, ELFORA Agro Industry Plc’s real estate development, Boston Partners lodge hotel international standard star designated restaurant expansion project, Jupiter Agro Farms Plc that produces vegetables and flowers for export and St.Mary’s Educational Development Plc higher education institution new project.

“We are currently going through documents of various companies and conducting an evaluation. We are checking to see if everything is done correctly. Accordingly we have put up a notice asking companies who do not have the appropriate and necessary documents to come and report to our office,” a PR officer at the Agency told Capital.

Some of the reasons for the licenses to be revoked include failure to renew the investment licenses as well as not starting the operations for which the license is issued for.

“Some of the companies acquired investment licenses for projects but end up failing to begin operations in the specific time provided by the law. These companies will have to provide a persuasive and acceptable reason in order to keep their license,” the PR officer also said.

The companies on the list are involved in a variety of sectors such as construction, tour operation, hospitals, restaurants, many of which specialize in Chinese cuisine, consultancy firms, higher education institutions, construction machinery rentals, flower farms, hotels and more.

According to the Agency, initially, the companies were given a window of 20 days to be able to fix the problem to stop their license from being revoked.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4035:investment-agency-revokes-licenses-of-over-1000-companies&catid=54:news&Itemid=27

.

Exports hit a head wind

.

![]()

.

Global economy plays a role but stagnation has been developing over two years

Ethiopia’s exports have bucked a trend and not performed as well so far this year.

For the last several years, the Ethiopian export sector has been growing consistently, though not reaching the targets set by the government. However, for the first time in recent history, the revenue generated from exports, in the 2012/13 fiscal year, declined when compared with the previous year’s performance.

The past six month’s performance is nearly 35pct lower than the target. During the first half of the 2013/14 fiscal year, which is from July 8, 2013- January 8, 2014, the country earned USD 1.311 billion from exports. But the government hoped to earn USD two billion during this period, which is 65.5pct of the goal. This is surprising because over the past decade exports had been growing and it is concerning because even though figures are still rising, exports were growing at a slower rate over the last 18 months.

In fact exports are 7.3 percent lower than the first six months of the 2012/13 fiscal year. This means that over the past two fiscal years (since 2011/12), even though exports have been rising; they have not been going up as rapidly as they had before. The last six months is the first time that exports have actually declined however.

Not all exports decreased, manufacturing and oil seed exports registered significant growth in the first six months of the fiscal year but agricultural products and mining declined. year report, the coffee trade has constricted 28 percent by volume and 38 percent by value compared with the past year achievement.

Other agricultural exports that decreased were oilseeds, flowers and pulses, although pulses, like khat, performed better than other farm products. In Ethiopia, the most prominent oilseeds are sesame. These seeds brought in USD 208.8 million over the past six months. This is 76 percent of the target, which was USD 273.2million, although oilseed exports have been growing rapidly over recent years. Pulse exports brought in USD 107 million, 84 percent of targets. Khat, was closer to its goal raking in USD 150 million or 92.6 percent, over the past six months.

Flower exports decreased reaching only 54.8 percent or USD 84.5million but it did grow 2.7 percent, compared with the first half of last fiscal year. Even though the government hopes to expand fruit and vegetable investment and export, its performance is very weak. The government targeted USD 62 million from vegetable and fruit exports in the first six months of this fiscal year, but the actual achievement was 36pct of the target or USD 22.3million. MoT planned to earn USD 1.07 billion from farming in the first six months of this fiscal year. Instead, they earned USD 815.7 million, 76pct of what they had hoped for.

The other sector that registered lower performance in the past six months is mining. In the extraction industry gold has been raking in a lot of money for the nation recently as people have begun finding more of it here and the price on the international market has been increasing. However in the first half of this fiscal year gold exports only met 59 percent of their targets. According to Ministry of Trade (MoT) report, some sectors did see their exports increase compared with first half of the past fiscal year but they failed to meet targets.

Exports were supposed to bring in USD 328 million but instead they earned USD 194 million. Some of the blame lies on the international markets which saw prices for gold and coffee decrease over the past six months. In general, the hard currency generation from mining contributed USD 199 million in the first half year, which is 28 percent lower than the similar period in the past fiscal year. In the first six months of the past fiscal year the country generated USD276.6 million form mining exports.

Changing from an agricultural led economy to an industrial one is a major Growth and Transformation Plan priority and the report indicated that industrial exports did earn more revenue during the stated period but only slightly more and less than half, (47.7 percent) of what they had planned on. The ministry wanted to earn USD 366.5 million from manufacturing, but the sector contributed USD175 million.

Leather and leather product exports on the other hand excelled, amassing USD 9.7 million; higher than the USD 57.4 million in revenue the sector earned a year ago. According to the report, Ethiopia exported USD 57.5million worth of garments and textiles. Yet, the goal was USD 111.8 million, although it is still a 27 percent increase compared with last year.

Last year’s export performance report indicates farming; mining and industrial exports earned a combined USD 3.08 billion. The performance shows a slight decrease when compared with the 2011/12 budget year’s performance that managed to rake in USD 3.15 billion birr in revenue. The performance of the past budget year is also USD one billion less than the target set by the Ministry which is a little over USD four billion.

By the end of the GTP, (June 2015), the government dreams of USD 10 billion from exports. A large part of Ethiopia’s plan to become a middle income country depends on producing more goods here and then exporting them to other nations instead of relying on imports. Many developing countries face an uphill climb when trying to improve the economic lives of their citizens because the playing field is not level, as a result they end up selling raw materials to foreign investors who then add value to them and earn huge profits or rely on ‘cash crops’ and other natural resources that are then exploited by large foreign corporations who do not offer a fair exchange.

Countries that have successfully developed in the past like China and India have done so by making their own products and exporting them in large numbers. When India first gained independence Ghandi saw this as the only way to achieve true freedom, one economic expert said. The Ethiopian government is counting on exports increasing dramatically and consistently in order to meet their many development goals. For this reason even if exports still rise, when they appear to be leveling off it is a cause for concern.

http://www.capitalethiopia.com/index.php?option=com_content&view=article&id=4034:exports-hit-a-head-wind-&catid=35:capital&Itemid=27

.

Coffee Competition Winners Announced

.

The competition is being used as a way to find the best coffee producers in the country

.

![]()

From left to right, Killele Tsegaye, representative of H.H.K. Industrial Plc, Wondesse Lemma representative of Lemma Edito & Children Plc, Hussien Agraw, president of the Ethiopian Coffee Exporters Association (ECEA), and Hailesellasie Ambaye general manger of Hailesellasie Ambaye Industrial Plc.

Three coffee producers and exporters – from Jimma (in Oromia Region) and Gedeo and Yirgachefe (in the South Region) –were recognized for producing the finest coffees out of 91 competitors.

Lemma Edito & Childern Plc, from Limu Kose in the Jimma Zone, came first, scoring 88.4 points with natural coffee, Second came H.H.K Industrial Plc from Gedio Zone (Southern Region), scoring 87.75 points – also with natural coffee. Hailesellasie Ambaye Industrial Plc from Yirgachefe (Southern Region) achieved 87.6 points with a washed coffee, and came third.

The African Fine Coffees Association (AFCA), in partnership with the Ethiopia Commodity Exchange (ECX), the United States Agency for International Development (USAID) and the Agricultural Growth Program-Agribusiness & Market Development (AGP-AMDe) – announced the 2013/ 2014 Taste of Harvest (ToH) coffee competition winners on Wednesday, February 5, 2014, at the Elily International Hotel, located in the Kasanchis area, along Guinea Conakry Street.

The winner of forth and fifth place was the Mormora Coffee Plantation from Guji (in Oromia Region). The plantation came fourth scoring 87.57 points, with washed coffee. The same company took a certificate scoring 87.5pts with natural coffee.

The top five winning coffees will be promoted next week at the Annual African Fine Coffees Conference & Exhibition (AFCC&E) in Bujumbura, Burundi, and whole coffee samples will be presented on the AFCA website to help promote them.

Based on the call of the AFCA Ethiopia Chapter for the test of harvest competition, 91 washed and natural samples were submitted to the ECX by 42 growers, 24 cooperative unions and 34 exporters.

Judges were selected by the AFCA Ethiopia Chapter Stirring Committee (Members represented from the industry), with a selection criterion of senior experts on coffee quality – representative from the Industry, licensed and qualified graders and experienced for the protocol and TOH events.

In the three-phased inspection, 91 coffee samples were submitted during the first phase. It was narrowed down to the top 36 high scoring coffees, during the second and to the top 13 high scoring coffees during the last one.

The occasion is a coffee cupping competition to identify the finest Ethiopian coffees, in order to promote quality coffee by way of contributing to the development and marketing of the industry.

Established in 2000, the AFCA is a regional association with its secretariat located in Kampala, Uganda. The organization’s mission is to promote the production, quality, consumption and trade of Africa’s fine coffees in its eleven member countries: Burundi, Democratic Republic of Congo, Ethiopia, Kenya, Malawi, Rwanda, South Africa, Tanzania, Uganda, Zambia and Zimbabwe.

The AFCA’s membership includes: producers, millers, exporters, international importers, roasters, policymakers, transporters and trade representatives.

http://addisfortune.net/articles/coffee-competition-winners-announced/

.

Ethiopia Will Lose Its Hegemony in East Africa If It Doesn’t Address Museveni Greed

.

By Pel K. Chol

opinion

Ethiopia is the second populous nation in the continent and a most populous in East Africa with a population of 85 million equaling the total population of Kenya, South Sudan and Uganda put together. The country is the fourth largest economy in the continent recently surpassing Kenya, making it the largest economy in East Africa.

Such combined are ideal blessings for any nation to keep its hegemony to a certain extent so as to protect its interests. Ethiopia, being a champion of Africa is blessed with such ideals in a multi dimensional ways, population size, economic wise and military strength, must not turn a blind eye on the situation of South Sudan otherwise it will lose its status if it allows Museveni to do what he likes doing ruining the lives of so many people in Uganda’s neighboring countries one of which is DR Congo where over four million people have died in spate of four years, more than those who died in the second world war.

Ethiopia, being a democratic nation with a strong constitution honored and respected by all Ethiopians, would have every right to tell Museveni to bugger off and let South Sudanese decide themselves their own future. If he (Museveni) got involved as a matter of keeping the neighborhood quiet, then Ethiopia would have every right to use the same phrase too because its borderline with South Sudan is far lengthier than that of South Sudan with Uganda and any noise Uganda may experience as a result of such conflict might also be felt by Ethiopia, Kenya, DR Congo and the Sudan requiring a bilateral response.

However, none of these is an issue which got Museveni involved in the conflict. Rather a friendship and a blood thirst. But what Museveni misunderstands is that he is backing the wrong side. Perhaps, not so wrong in his judgment because Museveni himself has been locking up and killing his political opponents.

The pretext Kiir told the world is now obvious. It is true that the coup attempt was a fabrication and a cover up of his ill conceived policies about what atrocities and gross human rights violations his Gogrial thugs had committed against Nuer civilians in Juba. Yet again he had tried very hard to divert public opinions of his alleged coup thinking that the majority of world leaders are as fool and delusional as his friend Museveni to believe him.

Upon that fateful night, for many innocent victims, many peace loving generals in the army who want to hold Kiir to account for his actions fought back to get rid of him. While Juba was about to fall, Kiir had ran to Uganda for help to keep him in power.

This shows how unpopular this dude is and that is why Ethiopia would need to intervene whatever way possible because if Kiir was a popular President among the South Sudanese, he would not have sought external support from Uganda or Sudanese rebels operating inside South Sudan territory who are all now terrorizing Jonglei, Unity and the Upper Nile States.

Another reason why Ethiopia can support Dr. Riek is because Dr. Riek has the backing of the majority of South Sudanese who all stand behind him including some prominent figures such as Rebecca Nyandeng, Deng Alor, Majack Agot, Lol Gatkuoth, Pagam Amum and many more.

Ethiopia must understand that the political situation in South Sudan is not a contention over leadership between Nuer and Dinka. Rather it is a quest for justice and establishment of a true democracy in South Sudan between democratic sympathizers, Dinkas included and a brutal dictator who acts like Isaias Afewerki of Eritrea whose rule has now emerged as an iron fist and crush who ever dare questioning his leadership style. Ethiopia would have nothing to lose if it chooses to push Museveni out of South Sudan. Rather it will gain an admiration from the majority of South Sudanese who are exhausted with Kiir and Museveni.

Kiir himself does not know any clue about the rule of law and what democratic principles are. This reveals why his administration is at odd with his SPLA party members majority of whom were educated in USA, UK and Australia holding masters and Ph degrees while Kiir does not even have an elementary certificate. The December 15 violence is an indicative of his illiteracy thinking that when he is the president of the Republic, then everyone else is useless and should listen to him. That is why he formed a private army with military unaware of that and ordered this illegitimate army to disarm members of the real army. When they resisted then he said it was a coup and it is Dr. Riek’s fault and his team who see his policies as a cancer to the nation.

All of Dr. Riek’s team including thoseKiir had jailed and those who ran for their lives now staging rebellion have sound knowledge of democratic governance and at best would work very well with the Ethiopian government should they get support and form a government . They felt victims to Kiir simply because of their wise knowledge about how democratic system should work in South Sudan.

Ethiopia must intervene to help restore democracy in South Sudan because if Museveni continue his military involvement in South Sudan, then Museveni would be the strongest man in East Africa by default worse than Idi Amin. To me and many other democratic sympathizers in South Sudan, Museveni does not deserve that connotation. He watered down democracy in Uganda, now he wants to water down democracy in South Sudan and East Africa in general.

How could anyone be certain that what he started in Congo, Rwanda, Burundi and Somalia is going to stop in South Sudan? As long as IGAD and the West turns a blind eye and deaf hear on his evil tactics and resource seek meddling, he can make things as bad as hell wherever he wants to. Obviously, he created carnage in DR Congo, Rwanda and Burundi and Somalia in the eyes of USA and her allies and yet no one condemned his evil favoritism. Let not underestimate that he could help change the regime in Sudan and also destroy wonderful democracy Ethiopia is now enjoying by supporting OLF being assisted by his mercenary Ugandan Peoples Defense Force (UPDF).

Hence, Ethiopia must intervene before Musevini’s tail even grows longer or else it would be too late to cut. Currently the mighty Ethiopian army would have no match with Uganda army.

If the freedom fighters far from being a standing army could inflict pain and suffering on Ugandan military with tanks and attack helicopters, then how could they match a mighty Ethiopian force.

My advice to Ethiopia is that they should intervene for your own hegemony, defense of democracy, and stability of East Africa. Ethiopia! Intervene and get Museveni out of South Sudan.

http://allafrica.com/stories/201402111473.html?viewall=1

.

Filed under:

Ag Related Tagged:

Addis Ababa,

Africa,

Agriculture,

Economic growth,

Ethiopia,

Ethiopian government,

Investment,

Sub-Saharan Africa,

tag1 ![]()

![]()

.

.